Conversation Starters – Know Your Business

- step525

- Aug 4, 2021

- 4 min read

Conversation Starters – Know Your Business

Entrepreneurs are, by nature, adventurous risk-takers. Successful entrepreneurs can often produce glorious profits without significant financials, merely flying by the seat of their pants. Entrepreneurs make decisions as they grow, they take opportunities and turn them into success, and they have a vision for standing out in their market.

But when you want to convince a Private Equity partner to get involved, this devil-may-care attitude will no longer succeed. You'll need to speak plainly, and you'll need documented financial information to back up your claims.

The 4 Areas of Knowledge

Here are 4 areas of financial-related information that are essential for any discussion with a potential partner, investor, or acquirer. Your intimate knowledge of these areas of your company will anchor the conversation and put you in a position to determine the best course to take to benefit your business.

Once you have these areas covered, expect the outcome to be a resounding "yes" that will lead to an expanding success of your business.

Profit & Loss

Leading the pack of knowledge is your Profit & Loss Statement – your top line revenue, your gross profit, and your bottom line net income. Make this a standard report that you look at every week. With it, you can see how your sales are performing, how your cost of goods sold in every sales class is performing, how each department is performing, and how the company’s Net Income is rising and falling by season.

A Private Equity partner will want to know how the company is faring every month - for 36 months! This history gives you the opportunity to talk about the trends and the anomalies with precision. You will own the discussion.

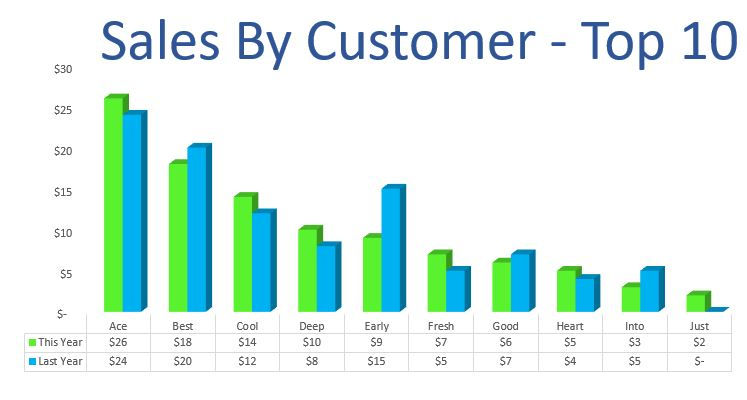

Customer Profiles

The next key area regards your customers – specifically, your top ten. Generate a report of Sales By Customer. Look at this report every month, with columns for prior months. Among all of your customers, which are consistently driving the most business for your company? Which comprise the least revenue but are the most important demographic (and why)? This information leads to keen insights that should drive your contracts, your marketing, and your deployment of salespeople.

Question your Head of Sales frequently about sales to the top performing customers and what sales and marketing tactics are driving the volume. Then take a closer look at SKUs by Customer as well.

A Private Equity partner will understand that 20% of your customers drive 80% of your business. They will want to see that no one customer drives more than 50% of your business. There are always exceptions, but this is the rule.

SKU Performance

Closely following sales by customer is a Sales By SKU report. Generate a Sales By SKU and a Sales By Brand (if you have multiple brands) and compare month-over-month. Again, look at your top ten. Which SKUs drive the most revenue and what is the Gross Margin on those top SKUs? Similarly, which SKUs are no longer key to your revenue stream - and why are you still carrying them?

A Private Equity partner will look to see how you make decisions around your marketing of SKUs and how you exit SKUs so that you are running efficiently. Make a habit of retiring slow-selling SKUs. (It’s like pruning a strong tree.) This enables you to talk about your policy for performance – a great topic for discussion.

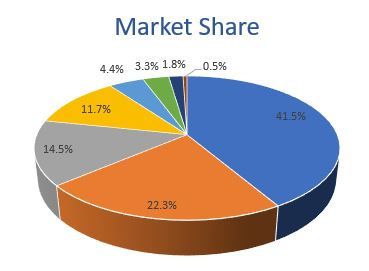

Market Presence

How do you compare to your competition? Can you measure your sales compared with your competitors’ sales in a channel? Which other brands are competing for the same position in the consumers’ eyes and the retailers’ shelf space? How much of the market pie do you command?

This is data that you can acquire via IRI, SPINS, directly from a distributor or retailer, or other market data services. Don’t rely on gut-feel - go get data to back your claims. Your point will be heard.

Dashboard for Opportunities

These four top pieces of information should become a ‘dashboard’ that you look at every morning. In addition, you can chart your statistical trend by comparing month over month and comparing this year to last year to the year before. Highlight the unusual events and be comfortable speaking about them.

For example, when you say, ‘we are doing better this year than last year’, add a dash of spice by citing where you are doing better and by how much in dollars and in percentage. Specify which set of SKUs or which geography or which channel of distribution. Identify if the improvement is in your gross margin or in net income or if it is statistically in consumer awareness translated into higher overall sales. Associate the ‘better’ to the category.

It takes these four areas of knowledge to anchor a relevant conversation. The dashboard of information is your driver in business and your directional in navigating opportunities. The best discussion is one that rapidly addresses the basics above and allows for the possibility of a transaction to come into focus.

Preparation

Fortune is always a bit of luck with a heavy dose of preparation. Have your data ready, and you will be supremely prepared for the next opportunity. Your conversation will start well and conclude with a “Yes’!

Contact Us

We can help you get ready for your conversation and bring your business to a whole new level.

Let's talk. JUSTMAN@RJMC.NET

Comments